IIAG Issues Policy Position on Homeowners Insurance Market

BY IIAG PERSONAL LINES COMMITTEE

Issue

The Georgia homeowners insurance marketplace has reached a critical point as carrier losses continue to outpace rate increases borne by consumers. This trend has led to dramatic changes in carrier underwriting standards, new business moratoriums, and significant increases in nonrenewal activities. Independent Agents face challenges serving consumers due lack of capacity in the homeowners insurance market and inconsistent application of non-renewal laws and regulations between carriers.

Loss Trends

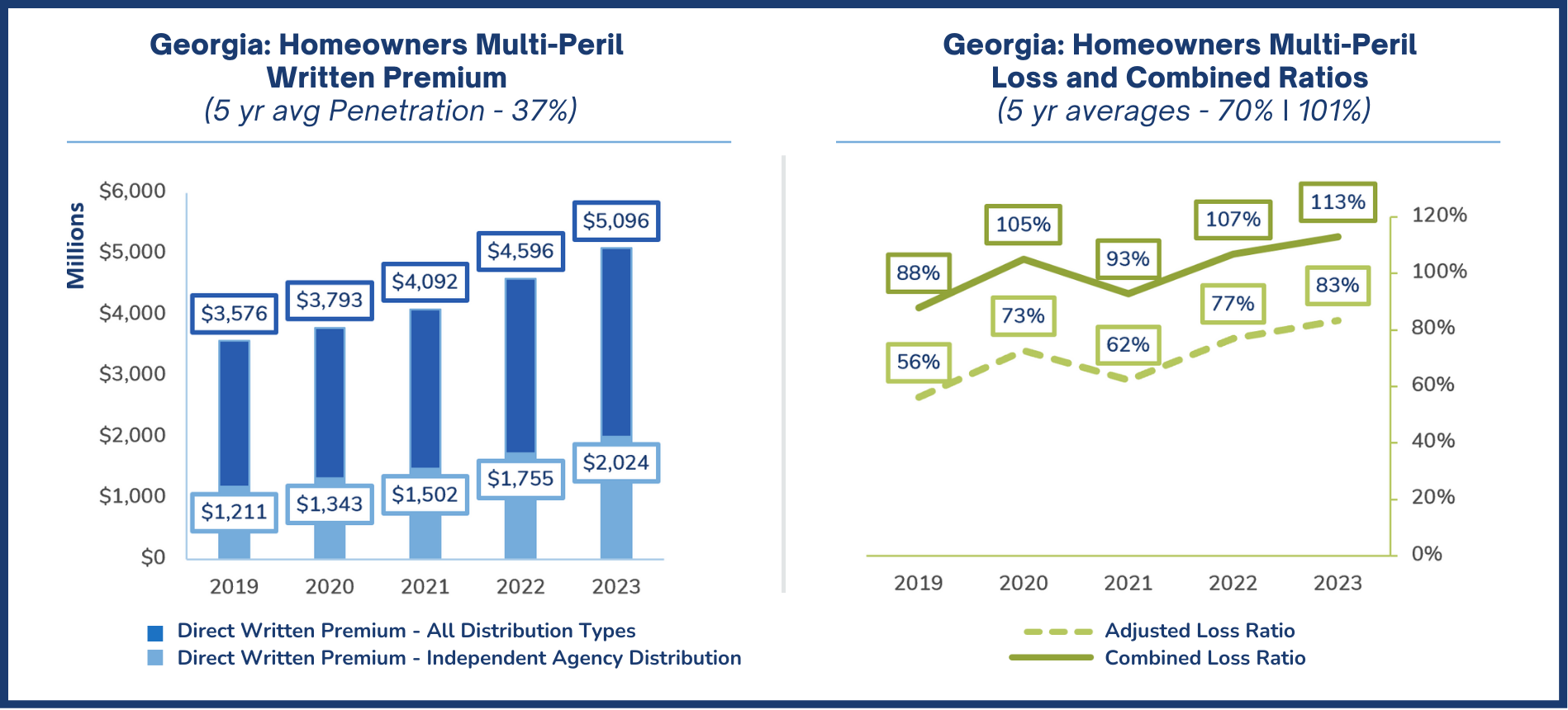

The below chart illustrates the increasing loss trends in Georgia's Homeowners Insurance market from 2019-2023. This chart is published in our 2024 P-C Marketplace Report, available for free download for IIAG Members.

Market Reactions

- Changes in Carrier Underwriting Standards:

- Property Questionnaires

- Restrictions on Roof Age

- Increased Focus on Roof Conditions

- Increased Focus on Prior Claims

- Rate Increases:

- AM Best data shows that Georgia homeowners insurance premiums increased by an average of 11% from 2022-2023 and an average of 9% annually between 2019-2023

- Non-Renewal Activities:

- Consumers have been faced with a dramatic increase in non-renewal activities primarily focused on roof conditions and new underwriting standards on roofs.

- New Business Restrictions / Reduced Capacity /Carrier Pullout

Suggested Market Actions

- Department of Insurance Review of Carrier Non-Renewal Activities

- New Guidance from the Department of Insurance on Carrier Non-Renewal Activities

- Encourage the Department of Insurance to Allow Additional Flexibility in Rate Filings

- Encourage review of Actual Cash Value (ACV) policies for roofs

- Encourage review of wind/hail deductibles and other similar mechanisms

- Encourage the Department of Insurance to Apply Roof Schedules Consistently Amongst Carriers

- Encourage consistency in the timeframe roof schedules can begin

- Encourage consistency in roof related ACV definitions between carriers

- Encourage consistency in depreciation schedules between carriers

Conclusion

The Independent Insurance Agents of Georgia (IIAG) desire to protect the interests of consumers while advocating for a holistic review of the homeowners insurance market. IIAG members recognize the relationship between roof related issues and carrier appetite in our state. IIAG members also recognize that the rights of Georgia consumers must be protected, and clearer guidance is needed on non-renewal and cancellation actions. IIAG encourages the Department of Insurance to issue additional guidance on homeowners insurance non-renewal activities as well as collaborate with industry advocates to investigate additional mechanisms in homeowners rate filings that can encourage carrier capacity in Georgia. ![]()

Member Benefit: Free ACORD Forms

Did You Know? IIAG members with annual P&C gross revenue of less than $50 million can receive a complimentary license to use ACORD forms (including digital) and the ACORD portal.